The S&P 500 for Web3

Diversified index tokens for the decentralized economy — transparent, permissionless, and community-governed.

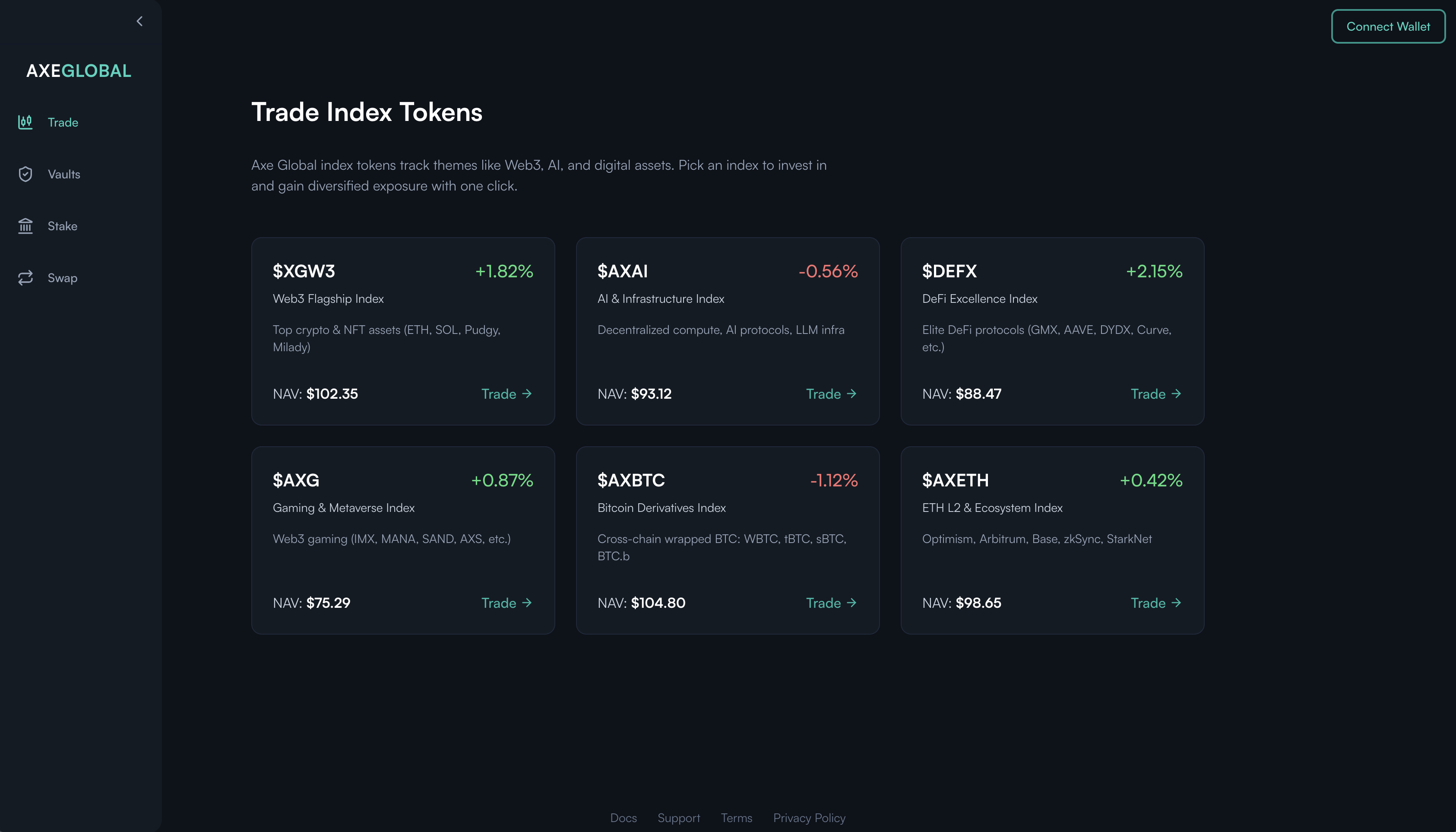

The platform: Synthetic Index Fund for Web3

Structural Inefficiencies in Web3 Investing

Portfolio construction in Web3 is still manual and error‑prone. Capital gets stuck across chains, execution is inconsistent, and building thematic exposure takes dozens of transactions.

Fragmented Liquidity

Assets live on different chains, bridges, DEXs/CEXs and NFT markets — each with their own UX, fees, and risks.

- Multiple wallets & gas tokens per chain

- Bridge risk, slippage, and settlement delays

- Inconsistent price discovery across venues

Operational Complexity

Maintaining a balanced basket requires constant rebalancing, tracking drift, and handling tax lots.

- Manual basket construction & maintenance

- Rebalance drift and tracking error

- Time cost → execution mistakes

Theme Access Gap

No ETF‑like primitive for buying an entire theme (e.g., AI+DePIN, NFT Blue Chips) with one click.

- High barrier for newcomers

- Dozens of transactions for simple exposure

- Institutional workflows don’t port cleanly

Axe Global’s Architecture & Approach

Axe Global blends Ethereum’s liquidity layer with a governance and methodology layer for index rules and NAV publication — a two-layer model optimized for speed, provenance, and security.

Hybrid Architecture

Ethereum/L2s handle liquidity; a registry anchors index definitions, NAV attestations, and governance.

Real‑Time Operations

Fast, low-latency updates for index changes and NAV postings with auditable data sources.

On‑Chain Verifiability

Composition, pricing, and rebalances are transparent and cryptographically verifiable.

DAO‑Driven Evolution

$AXE governance steers listings, weights, fees, and treasury — progressively decentralized.

$AXE — Native Currency & Governance

$AXE is the unit that powers fees and governance across Axe Global. Holders participate in the DAO and steer protocol evolution.

Utility

Pay mint/redeem and protocol fees, unlock index lifecycle actions, and access new listings.

Governance

Propose & vote on listings, index weights, parameters, and treasury policy via the DAO.

Treasury

Fees accrue to the treasury for audits, security, liquidity, and ecosystem growth.

Why Investors Choose Axe Global

Multi‑Trillion TAM

Digital assets are scaling into a global asset class. Axe tokens provide disciplined, diversified access.

Global Reach

Designed for retail and institutions with transparent index rules and verifiable on‑chain data.

Sustainable Economics

Mint, redeem, and protocol fees align incentives and fund ongoing product and security work.

First‑Mover Edge

On‑chain, theme‑based index products with DAO‑driven evolution and real‑time NAV publication.